Last Updated on: October 27, 2025 by Carlos P. Barry

When thinking about whether or when to claim Social Security benefits, the question almost everyone asks themselves is:

Is it better to take Social Security at 62 or 67?

This is among the most significant decisions that you’ll face in retirement. It will affect your monthly income for the rest of your life — especially as our life expectancies continue to go up, along with the cost of living

This article will help you weigh the pros and cons of taking Social Security early at age 62 versus waiting until full retirement age at 67. And then we’ll examine the personal and financial reasons that might determine your decision.

What You Need to Know About Social Security Retirement Ages

Social Security benefits allows you to start claiming retirement benefits at age 62, but if you file for retirement before your Full Retirement Age (FRA) — which is 67 for most people today — the size of your benefit will be permanently reduced. On the other hand, if you wait beyond FRA all the way to age 70, your benefits will increase still further.

Here’s a quick summary:

- 62 — Earliest claiming age, up to 30% benefit cut permanently.

- 67 you would get 100% of your Primary Insurance Amount (PIA).

- 70 — The highest age at which to claim Social Security; benefits rise by 8% for each year of delay beyond FRA.

- You can get a personalized estimate using the SSA’s Social Security Retirement Estimator.

Claiming Social Security at 62

✅ Pros of Claiming at 62

- Earlier Income

You get earlier access to income if you start at 62. If you require money because of retirement, job loss, health reasons or some other personal situation, collecting at 62 can bring about financial relief. - More Total Checks Received

Claiming at 62 rather than 67 amounts to getting a total of 60 additional monthly checks over five years. Even if the payout for every get is smaller, you might wind up gaining over all — at least if you don’t live into your mid-70s - More Time to Enjoy Retirement

Of course, not everyone will live long enough for the so-called “break-even age” — the age at which the bigger checks you’d receive at FRA or beyond would catch up to what you received in smaller amounts starting at 62. Claiming your benefit early could provide you more healthy years in retirement.

❌ Downsides of Claiming at 62

- Permanent Reduction in Benefits

You can lose up to 30% if you claim at 62. If a $2,000/month FRA benefit is likely for you at 67, you could get say only about $1,400/month beginning at 62. That $600 differential will last a lifetime. - Earnings Test Reductions if Still Working

If you want to work while claiming before F.R.A., be aware that Social Security has an earnings test. For 2025, that cap is about $22,320: Every $2 over the limit will cut your benefit by $1. You can get an idea by checking the S.S.A.’s earnings test calculator for details. - Smaller Spousal & Survivor Benefits

Your spouse or survivors are also affected by your Social Security benefit. While claiming early reduces the amount you will receive as a retiree, it also cuts spousal and survivor benefits — and if you are a lower-earning spouse yourself, or have someone financially dependent on your work record, this is a big deal to consider.

Check out our web story “Best 6 Ways to Lower Your Taxes on Retirement Savings”

Taking Social Security at Age 67

✅ Pros of Claiming at 67

- Full Monthly Benefit

Filing at your full retirement age (now 67 for most people who are about to retire) nets you 100% of whatever you earned over your working lifetime. - More Benefits Over the Course of a Longer Life

Those who live into their mid-80s and beyond may get more money over their lifetime if they wait. Let’s take a simple example:

| Age Claimed | Monthly Benefit | Total Received by Age 85 |

| 62 | $1,400 | $386,400 |

| 67 | $2,000 | $432,000 |

By age 85, if you waited to claim until 67 you could end up with a little under $46,000 more.

- Spousal and Survivor Benefits

In waiting, you also jack the payouts your surviving spouse would receive after you die — particularly crucial if they depend on your benefit as part of their income.

❌ Drawbacks of Delaying to 67

- Delayed Income

If you need income to pay bills in your early 60s, waiting can mean depleting savings, 401(k)s or other savings accounts. That could leave you in a precarious position with potential market volatility and tax consequences. - Uncertain Health or Life Expectancy

And if you have health problems, or a family history that seems to predict less than average life expectancy, postponement could mean fewer checks in total. - Missing Early Retirement Opportunities

If you are interested in traveling or new experiences early on in retirement — when you might be physically capable of doing so — the value of getting benefits beginning at 62 may matter more to you than picking up a higher monthly benefit at age 67.

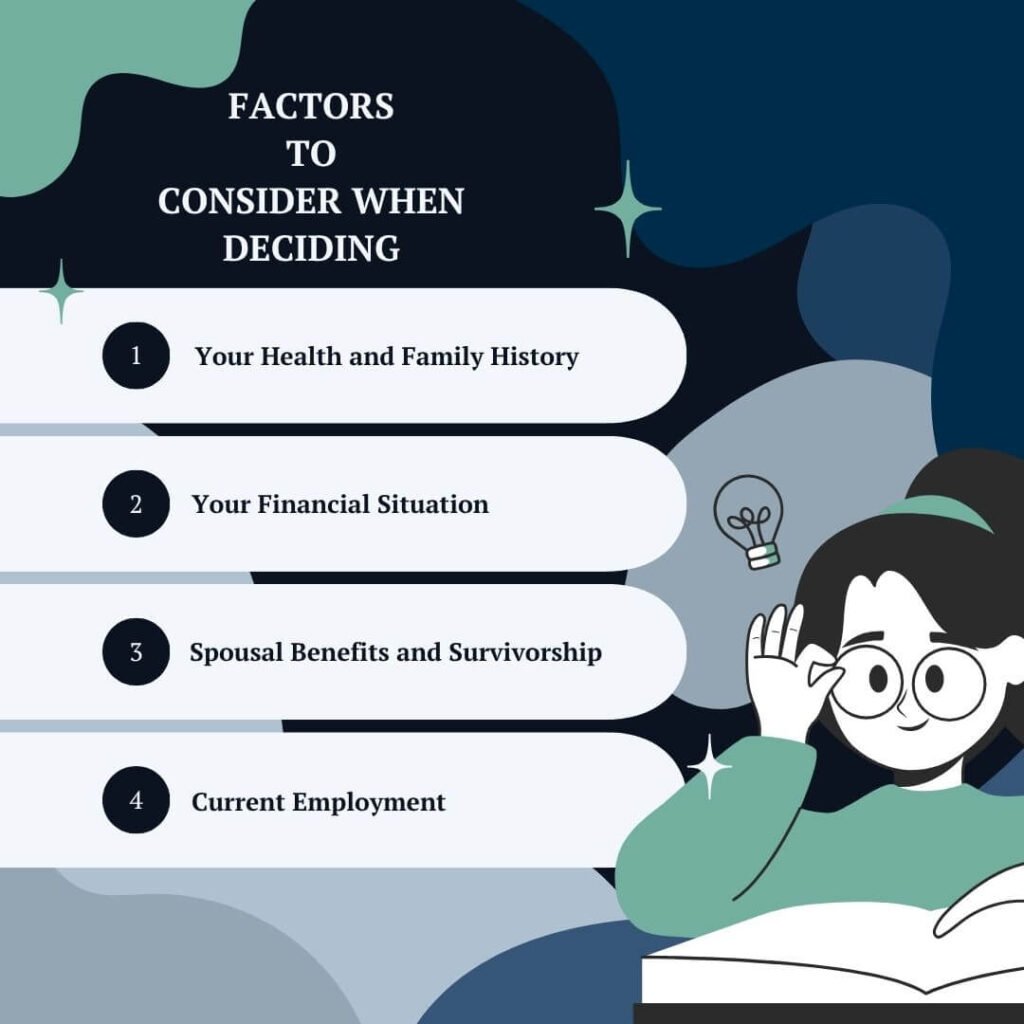

Factors to Consider When Deciding

1. Your Health and Family History

If you have good reason to think that you’ll live into your mid-80s or beyond, waiting could make financial sense. Conversely, if you are in poor health and claiming at 62 will help you get the most bang for your buck over your lifetime.

2. Your Financial Situation

Do you rely on the income to live? If so, it might make sense to claim early. But if you have savings and other sources of income (pensions, investments), waiting can increase your Social Security benefit — giving you a larger, inflation-adjusted stream of guaranteed income later in retirement.

3. Spousal Benefits and Survivorship

If you are the higher earner, waiting until FRA or even 70 can mean more benefits for a surviving spouse after your death.

4. Current Employment

If you’re still working and making high wages before FRA, collecting early can cut the benefit amount because of the earnings test. But that’s no longer a problem if you wait until FRA.

Break-even Analysis

A key consideration in deciding is determining your breakeven age — the point at which your total benefits over time, taking into account how much larger they’d be if you wait, will exceed those if you claim earlier.

Here’s a simplified example, assuming:

- Age-62 benefit: $1,400/month

- Age-67 benefit: $2,000/month

You could be entitled to $84,000 ($1,400 x 60 months) over the first five years (between ages 62 and 67).

To compensate for that $84,000 gap on a check that is $600 higher each month ($2,000 – $1,400), you would need 140 months or roughly 11.7 years.

You’d break even around age 78.7, in other words.

If you make it past 79, waiting is definitely worth the wait. If not, collecting earlier could give you more total dollars.

Inflation and COLA Impact

As we age, the Social Security benefits received go up to reflect increases in the cost of living through an annual Cost-of-Living Adjustment (COLA). Delaying when you start to receive Social Security benefits means that for every year you wait (until age 70), the base figure upon which cost-of-living increases are calculated is bigger — potentially a huge deal as you age and bills mount.

Check out our web story “7 Best Place to Retire in US”

Real-World Scenarios

Scenario 1: Health Concerns

Mary, 61 An early health scare — Mary doesn’t expect to live past 75. If she claims at 62, he will have the benefit of income from her claim while they can best enjoy it, and she gets as much money given to her in V.B.I. as possible over a shorter lifespan that is likely to be below average.

Scenario 2: Strong Family History of Longevity

Mark, also 61, comes from a long-living family: Most of his relatives survive into their 90s. And when he waits until 67, or even 70, he may get a much larger benefit that will help carry him through his later years.

There’s no one-size-fits-all answer. The choice to start Social Security at 62 or 67 is very personal. It remains to be seen based on your health, financial needs, life expectancy and goals for retirement.

If you’re not sure which route to take, discuss your options with a trusted financial advisor or take advantage the Retirement Age Chart and other online calculators at the SSA. They’ll assist you in modeling novel alternatives and understand what’s right for you.

And don’t forget — this is a lifelong decision. Just take your time, do some research and be sure you’re comfortable before making a claim. Retirement is one of life’s sweetest gifts, the reward for long decades of study and work — you owe it to yourself to arrange it so that you enjoy it as much as possible. most crucial step is to thoughtfully consider the things that matter most so either path you follow aligns with your goals of a comfortable and satisfying retirement.

YOU CAN ALSO READ :

*Best 15 Hobbies for Elderly at Home to Keep Them Busy and Happy

*Best 10 Dress Code Ideas: What to Wear to A Retirement Party?

*Best Retirement Party Decorations Ideas to Make It Memorable